It can be intimidating to navigate the mutual fund investment landscape, particularly when attempting to forecast future returns. Explore the vast realm of digital financial tools that have the potential to revolutionize your investment planning process. You can see how your systematic investments will increase over time with the use of a sip return calculator, which acts as your own personal financial forecaster.

Uncovering the Secrets of the SIP Calculator

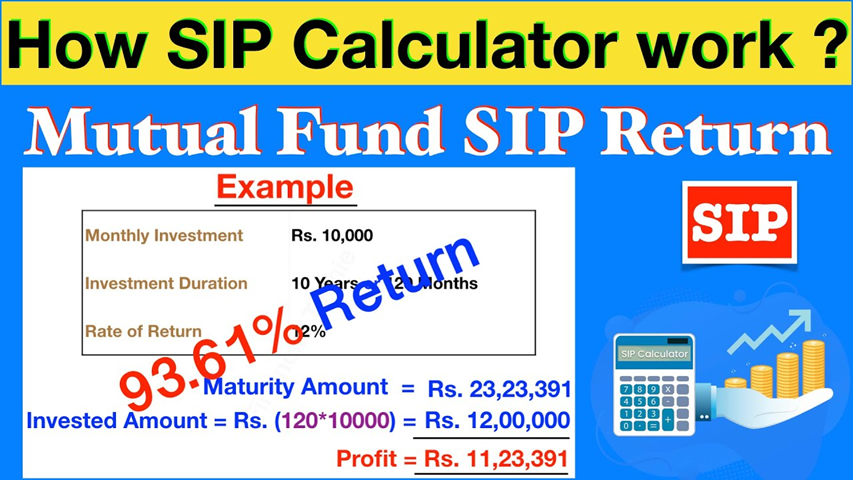

Investment planning becomes less mysterious when one understands how these calculators operate. Three crucial inputs are required by the systematic investment plan calculator in order to produce precise financial future estimates.

The monthly investment amount you intend to contribute and the anticipated annual rate of return from the funds you have selected are key components of the computation.

• The length of your investment or time horizon for your objectives

• The frequency of compounding that increases your returns

The calculator makes use of an advanced algorithm that takes into consideration the power of compounding, which is the process by which your returns eventually produce returns of their own. Instead of depending solely on conjecture, this mathematical accuracy enables you to make well-informed decisions.

Handling Calculators for the First Time

Utilizing websites such as angelone.in makes the computation process quite simple. Start by deciding if you want to figure out how much you need to invest to meet a certain goal or base returns on a predetermined monthly amount.

Process breakdown in detail:

Set your investment schedule in years, enter your desired monthly SIP amount, enter the anticipated yearly return percentage, and instantly check the projected maturity value.

To find the necessary monthly investment for target-based planning, go backwards and enter your financial goal amount, timeframe, and anticipated returns.

Examining Opportunities for Union Mutual Funds

Union mutual fund schemes provide a wide range of possibilities for investors with varying market capitalizations and risk tolerances. From aggressive growth funds to balanced hybrid choices, its portfolio caters to a wide range of investor needs and risk tolerances.

The fund company offers debt funds for cautious investors as well as a variety of equity schemes, from large-cap stability to small-cap growth potential. You can enter reasonable return expectations into your calculator by being aware of these alternatives.

Increasing Calculator Precision for Improved Planning

Realistic input assumptions are critical to the accuracy of your estimates. Examine the past performance information of the fund categories you have selected, but keep in mind that past success does not ensure future outcomes.

Astute computation advice: • For long-term planning, use cautious return predictions; • Take into account expense ratios that impact net returns; • Take market volatility into account when making projections; • Account for the impact of inflation on purchasing power.

Maintaining your investment plan in line with shifting market conditions and individual circumstances requires regular portfolio evaluations and calculator adjustments.

Convert Calculations into Action for Investments

The next step is to choose suitable mutual fund schemes that fit your risk tolerance and expected returns after you’ve used the calculator to examine different scenarios. When making your final decision, take into account elements including consistency of performance, expense ratios, and fund management quality.

The calculator is a good place to start when making well-informed investment decisions, but the best foundation for long-term wealth development through systematic investment planning is created when you combine these insights with expert guidance and in-depth study.